Are you constantly finding yourself short on cash? It’s easy to lose track of where your hard-earned money goes, but fear not! With a simple budgeting sheet, you can regain control and make informed decisions about your finances.

Most smartphones today offer access to Microsoft Excel or other spreadsheet applications. It’s highly recommended using this tool to create a budget. By analysing your bank statements and inputting the data into the spreadsheet, you can categorise your expenses based on your pay cycle—whether it’s weekly, fortnightly, or monthly.

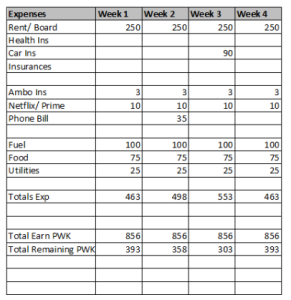

Once you’ve identified your expense types and their corresponding due dates each month, enter them into the table provided in the rough period they fall under. Take a look at the example budget table below.

After entering each expense, calculate the total amount you are spending and subtract it from your minimum wage. You can use formulas to automatically update these calculations if you make any changes. This will give you a basic understanding of how much money you need and when it’ll be deducted.

If you find yourself in a financial crisis, don’t hesitate to reach out to the MAS National Support team for guidance or seek support from your bank’s financial advisor. Remember, you’re not alone, and there are resources available to help you navigate through tough times.